Poor software and a tendency to make only small sequential changes are some of the reasons why economic analysts at the Bank of England failed to predict and prepare for the cost of living crisis caused by high inflation, according to a report “a once in a generation.” analysis.

The review announced last year was held by the former head of the US central bank, known as the Fed, and said the quality of the Bank’s economic expectations “has deteriorated significantly in recent years” due to outdated software and “excessive incrementalism.”

Economic shocks “by their nature are difficult to predict”

Although the “unusually large forecast errors” were considered “probably unavoidable,” according to the review, led by Dr. Ben Bernanke.

The problem was not exclusive to the Bank, but rather something that all central banks and private analysts suffered from, he said.

Unprecedented major global shocks have damaged economies around the world and driven up prices.

COVID lockdowns have caused shortages and supply chain bottlenecks, while the invasion of Ukraine has sent energy prices soaring.

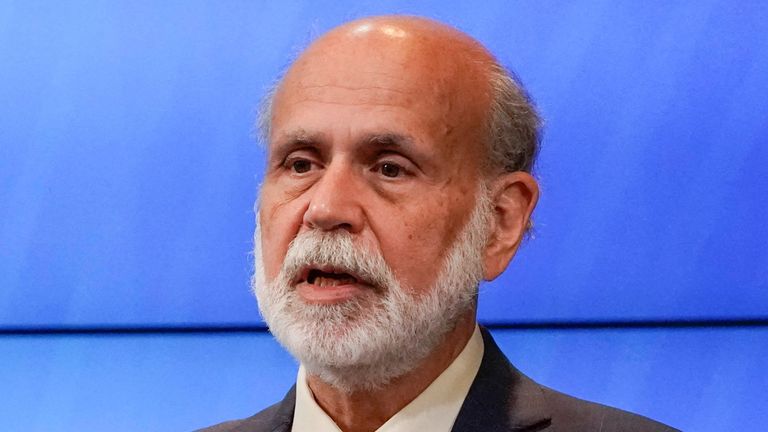

Well Bernanke. Photo: Reuters/Ken Cedeno

Such events are “by nature difficult to predict,” Dr. Bernanke’s review said.

The Bank had made a series of inaccurate forecasts – such as expecting a year-long recession and not taking into account the impact of wage rises on inflation – and was accused of not raising interest rates sufficiently or early enough to slow down. inflation.

Interest rates have now risen to 5.25%, a 2008 financial crisis-era high, in an effort to remove money from the economy and slow down activity.

One of the ‘most serious problems’

One of the “most serious problems” with forecasting at the Bank, the analysis said, is “the core software is outdated and lacks important functionality.”

There has been “material underinvestment” due to short-term pressures at the Bank, Dr. Bernanke said.

“Large financial investment” is needed to fund improvements, the review said, although amounts were not discussed.

New ways of doing things

New forms of forecasting should also be adopted, according to Dr. Bernanke’s report.

To be more precise, the Bank should model several economic scenarios, including if wage prices rise.

Greater attention should be paid to regularly reviewing supply chains, labor market supply and trade policy.

Modeling should also be done for other sectors that impact the economy, including the financial, housing and energy sectors.

Read more about business:

Sub-postmaster wrongfully sent to prison rejects apology

Port Talbot metalworkers vote to strike

Telegraph suitor to leave GB News owner’s board

The Bank welcomed the review, with Bailey stating that work to implement the recommendations has already begun.

However, it will take “some time” to develop detailed plans before they are even implemented, he added.

No timeline for adoption was provided, although Bailey said “a phased approach to implementing changes will likely be appropriate for a program of this scale.”

Bailey admitted last year that there were “really big lessons” to learn on how the central bank has dealt with the economic shocks of recent times.

Dr. Bernanke ran the world’s largest economy through the 2008 financial crisis while heading the Federal Reserve.

This story originally appeared on News.sky.com read the full story