Spirit AeroSystems was a little-known company outside the aviation industry until January of this year.

Then, however, the airframe manufacturer was thrust into the spotlight when a Boeing 737 MAX jet operated by Alaska Airlines suffered an accident. explosion in the air of a port plug.

Spirit, whose Wichita, Kansas, operation had manufactured the jet’s fuselage, saw its shares plunge as much as 20% and found the quality of its work was under heavy scrutiny as Boeing struggled to convince regulators and customers that its aircraft were safe.

The fuselage was later found to contain faulty rivets, but a preliminary report by the US National Transportation Safety Board (NTSB) also found that it was missing four screws needed to secure the door cover – pointing to mistakes made by the fuselage workers themselves. Boeing at its factory in Renton. Washington.

Latest Money:

‘Shadow’ new security measure seen at Tesco

One quickly touted solution to resolve quality issues at both companies was for Boeing to acquire Spirit – which was originally part of Boeing but was spun off as a separate company in 2005.

The duo began negotiations in March this year and, today, an agreement was reached.

Boeing will pay $4.7 billion (£3.7 billion) in shares to acquire Spirit. It will also take on Spirit’s debt – giving the business a total enterprise value of $8.3 billion (£6.6 billion).

The Alaska Airlines flight was forced to make an emergency landing with a hole in the fuselage in January. Photo: Reuters.

Separately, Spirit will pay Airbus $559 million to take over work done for the European aircraft maker at four of its factories. These include the production of A350 fuselage sections in Kinston, North Carolina and in Saint Nazaire on the west coast of France, as well as the production of wings and mid-fuselage for the A220 in Belfast.

The latter, which employs more than 3,000 people, is one of Northern Ireland’s largest private sector employers and its second largest manufacturing employer.

The sale to Airbus marks the second time the operation has changed hands in five years. It was acquired by Spirit in 2019 from Canadian engineering company Bombardier – which in turn bought the business, previously called Short Brothers, in 1989. Shorts, founded in 1908, claimed to be the world’s first aircraft manufacturer after receiving an order the following year by aviation pioneers Wilbur and Orville Wright. Moved to Belfast in 1936.

The acquisition of Spirit took some time to complete due to the involvement of Airbus, which was reportedly seeking $1 billion in compensation for taking over operations – which also include a facility in Casablanca, Morocco.

The Airbus operation – which is being compensated because the operations it takes over are loss-making – has echoes of a agreement that Airbus closed with Bombardier in 2017 to purchase the latter’s C-series small jet program for just US$1. The jet was later renamed the A220.

Use the Chrome browser for a more accessible video player

2:53

From March: What’s Happening at Boeing?

However, not included in the sale are Spirit’s other operations in Belfast, which work for customers other than Airbus, and operations in Prestwick, South Ayrshire, which support Airbus programs. Spirit said today it intends to sell these two businesses and a third in Subang, Malaysia.

For Boeing, taking over the activities of its largest supplier is extremely important as it seeks to better integrate airframe manufacturing into its global processes, a key element in its goal of overseeing quality control more effectively.

As Boeing chief executive Dave Calhoun said: “By reintegrating Spirit, we can fully align our commercial production systems, including our quality and safety management systems, and our workforce with the same priorities, incentives and results, focused on safety and quality.

“We believe this agreement is in the best interests of the flying public, our airline customers, Spirit and Boeing employees, our shareholders and the country as a whole.”

Use the Chrome browser for a more accessible video player

0:27

Boeing CEO: We fly safe planes

A struggling company absorbs another

However, no one should be under any illusion that this is a company in difficulty taking over another company in difficulty.

The integration of Spirit and its 14,000 employees into Boeing will take a long time – and, consequently, it will take some time before the company can convince its stakeholders that it must address quality issues both at Spirit and in its own operations.

It is also worth mentioning that the deal, which should only be closed in the middle of next year, is being done in shares and not in cash.

This aims to protect Boeing’s credit rating as the company, which has debts of almost $58 billion, fights to avoid a descent into “junk” status.

Keep up with the latest news from the UK and around the world by following Sky News

Moody’s joined S&P and Fitch in April in downgrading Boeing’s credit rating to ‘Baa3’ (also known as triple B minus), while all three have Boeing on a so-called ‘negative outlook’ list – which means it could be downgraded even further in the future. A downgrade to junk status would expose Boeing to the risk that some investors would not be allowed to buy its bonds in the future.

Brian West, Boeing’s chief financial officer, told investors in April that the company — which burned through $4 billion in cash in the first three months of the year — was making it a priority to maintain an investment-grade rating.

Meanwhile, Bloomberg reported over the weekend that Boeing will be charged with fraud after violating the terms of a 2021 deferred prosecution agreement with the US Department of Justice in May of this year. This could expose the company to tens of millions of dollars in fines.

So while this deal with Spirit is likely a step in the right direction, Boeing still has numerous challenges to face.

More from Sky News:

Strikes called off at Port Talbot steelworks

Energy price cap falls today but ‘£600 increase on future bills’

Who could take over as head of Boeing?

Perhaps the biggest question still posed by investors is when the company will name a new chief executive to replace Calhoun, who in late March announced he would resign before the end of the year.

Stephanie Pope, a longtime Boeing executive who became chief operating officer earlier this year, is the top internal candidate, but Boeing is believed to be interested in hiring a new sweeper from outside the company.

This process, however, took time. The Wall Street Journal reported last month that Larry Culp, chief executive of GE Aerospace, turned down the job – while others linked to her include Wes Bush, former chief executive of aerospace and defense giant Northrop Grumman.

Greg Smith, president of American Airlines and former chief financial officer of Boeing, is another who has been informed.

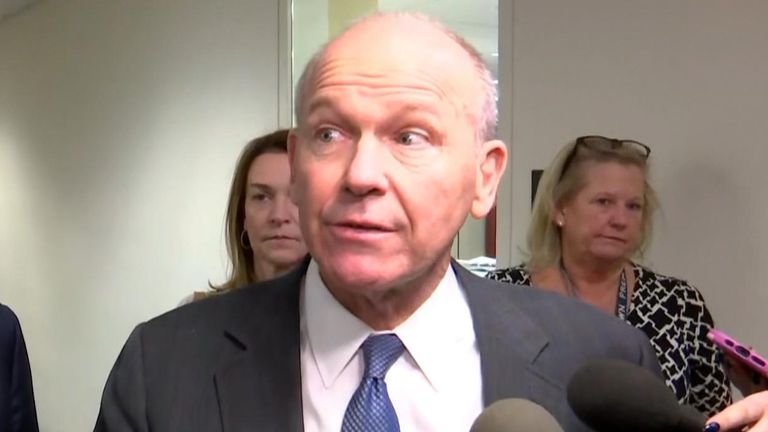

The most intriguing candidate, however, is Pat Shanahan, who became Spirit’s chief executive in October last year and who previously spent 31 years at Boeing and served as U.S. deputy secretary of defense. He was at the center of negotiations to sell Spirit to Boeing and can now be seen as the front-runner.

This story originally appeared on News.sky.com read the full story

/cdn.vox-cdn.com/uploads/chorus_asset/file/23985512/acastro_STK091_01.jpg?w=300&resize=300,300&ssl=1)