The “Magnificent Seven” – Litter, Microsoft, Nvidia, Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), Amazon, Metaplatforms (NASDAQ:META)and Tesla — have caught the eye this earnings season. And for good reason – the group has been instrumental in leading the market higher in 2023 and 2024.

After blowing analysts’ earnings estimates out of the water, Meta Platforms rose as much as 11% on August 1 – only to give up most of those gains at the close on August 2, as a widespread sell-off in mega-cap growth stocks spread across the markets.

A weak unemployment report and disappointing guidance from Amazon were some of the catalysts driving the broader market sell-off. And while some investors may be tempted to buy Amazon, Meta looks like an even better option growth stock to buy now.

Meta’s impressive numbers

Compared to the same quarter in 2023, Meta’s revenue increased 22%, operating margin was 38% compared to 29%, and net profit increased 73%. Meta continues to justify price increases, with ad impressions increasing 10% across its family of apps and the average price per ad also increasing 10%. The number of people active daily on its apps was 3.27 billion in June 2024, an increase of 7%.

Meta lowered its revenue guidance for the third quarter to a range of $38.5 billion to $41 billion. For context, Q3 2023 revenue was $32 billion — meaning the midpoint of its guidance would be a 24% year-over-year increase. This is a significant acceleration compared to the 11% jump in revenue between Q3 2022 and Q3 2023.

The Target expects full-year capital expenditures to be $37 billion to $40 billion – up from the previous range of $35 billion to $40 billion. “While we continue to refine our plans for the coming year, we currently expect significant capital expenditure growth in 2025 as we invest to support our artificial intelligence [AI] research and product development efforts,” Meta said in its earnings release.

Overall, Meta is growing its revenue and expanding margins, and expects to accelerate spending to drive growth.

Full steam ahead

In a relatively short period of time, Meta adapted to the TikTok threat – which, in retrospect, was probably a positive outcome for Meta because it led to innovation and better monetization through Reels and other improvements. Meta has become the closest business possible to perfection. It has a dominant position in its applications. It is growing operating profit faster than sales, which has led to margin expansion. And this is despite losing billions on Reality Labs every quarter.

Reality Labs refers to the company’s other investments, such as Ray-Ban Meta Smart glasses, virtual reality headsets and more. In the six months ended June 30, Reality Labs generated $793 million in sales and had an operating loss of $8.33 billion, while the family of apps had revenue of $74.73 billion and made $ 36.999 billion in operating profit.

Without being burdened by Reality Labs, Family of Apps would have an operating margin of almost 50% – which is extremely impressive.

The losses at Reality Labs would be inexcusable at virtually any other company. But Meta can afford it – which is a testament to the strength of Instagram, Facebook and WhatsApp.

The performance of the Meta family of applications is so strong that the company can accelerate its spending, repurchase shares and pay dividends.

Meta’s research and development (R&D) expenses have increased more than three times over the past five years, which has outpaced growth in revenue and operating income.

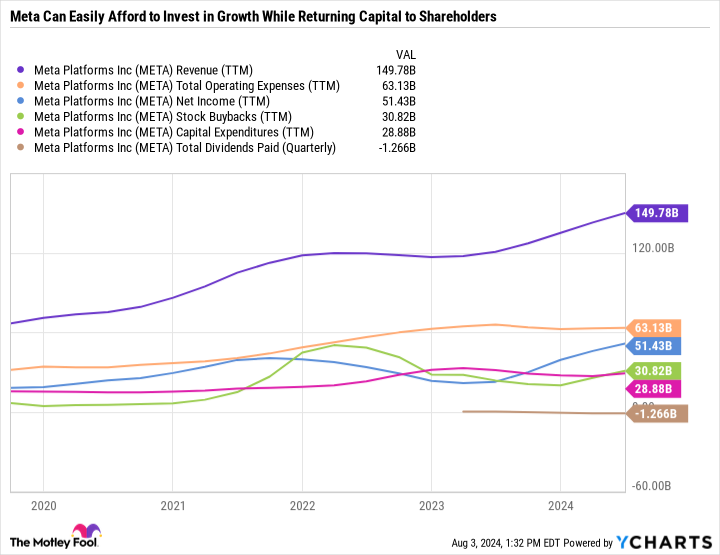

As you can see in the following chart, Meta is converting nearly a third of revenues into net income, while supporting increased capital expenditures and a massive buyback program that is about six times the size of its dividend expenditures.

To top it off, Meta has an impeccable balance sheet – ending the quarter with $32.05 billion in cash and cash equivalents and $26.04 billion in marketable securities, compared to just $18.39 billion in long-term debt.

Expanding leadership

When a company is producing extraordinary results, it’s easy to fall in love with the numbers. While the Goal deserves a lot of credit for its results and attention should be focused on finances, it’s also important to think about the bigger picture.

Meta is not just doing well now – it is laying the foundation for sustained growth. It’s one of the best examples of a company aggressively investing in AI and making those investments pay off. Meta has developed AI tools to help with content creation and follower engagement, create intentional ads, and provide accurate analytics. Basically, Meta’s business model is focused on increasing engagement so that advertisers see its digital space as more attractive.

In the second quarter of 2024, compared to the same quarter two years ago, Meta increased its advertising revenue by more than $10 billion, or 36%, to $38.33 billion. For context, Alphabet’s Google Search combined with YouTube generated $57.12 billion in revenue in the second quarter of 2024 – which represented an increase of just 19% over two years. Meta is innovating quickly and its results prove that its efforts are paying off.

What impresses me most about Meta is that it is yet holding. It didn’t need to implement its first dividend earlier this year or buy back almost the same amount of shares. Its R&D expenses over the past 12 months are $40.3 billion, compared to $30.8 billion in buybacks. It’s on track for about $5 billion a year in dividend expenses, which means if it didn’t have a capital return program, it could be spending about 85% more on R&D.

This margin for error gives Meta an invaluable advantage in the age of AI. This means that the company can make many mistakes, take risks and try new projects. Reality Labs didn’t pay off, but the company is still thriving. But if Reality Labs eventually contributes to positive operating profit, it could take Meta’s valuation to new heights.

So much growth at such a low price

Meta’s market position and ability to invest in innovation position it as the leading digital advertising destination. If the company keeps this up, I expect Meta’s family of apps to surpass Alphabet’s Google search and YouTube’s advertising revenue within the next five years.

Despite the growth and capital return program, Meta Platforms is not an expensive stock. It trades at a P/E ratio of 25. This makes Meta less expensive than S&P 500 or basic consumer products such as Coca Cola and Procter & Gamble.

Adding it all up, Meta is arguably one of the fastest growing stocks, and top stocks in general, to buy right now.

Should you invest $1,000 in Meta Platforms now?

Before buying Meta Platforms shares, consider the following:

THE Motley Fool Stock Advisor the team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now… and Meta Platforms was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $643,212!*

Stock advisor provides investors with an easy-to-follow plan for success, including guidance on building a portfolio, regular analyst updates, and two new stock picks each month. THE Stock advisor service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 6, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an Alphabet executive, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The motley fool has a disclosure policy.

Instead of Buying “Magnificent Seven” Stocks Like Amazon, Consider This Growth Stock was originally published by The Motley Fool

/cdn.vox-cdn.com/uploads/chorus_asset/file/24090214/STK171_VRG_Illo_4_Normand_ElonMusk_04.jpg?w=300&resize=300,300&ssl=1)