Advanced microdevices (NASDAQ:AMD) hasn’t received much support on Wall Street lately, which is evident from the 23% drop in the company’s share price since hitting a 52-week high in early March.

The stock was punished due to weaker-than-expected growth in the artificial intelligence (AI) business in the first quarter of 2024, as a result of which the company missed market growth expectations. Additionally, the stock was recently downgraded by Morgan Stanley to neutral from overweight, with the investment bank highlighting that investor expectations regarding the growth of its AI business are on the higher side.

The bank added that it sees limited upside in AMD shares despite recovery in the company’s core business segments. However, it may be too early to cancel this semiconductor stock for a few simple reasons. Let’s take a look at two of them.

1. AMD is in an excellent position to capitalize on growing sales of AI-enabled computers

According to Mercury Research, AMD’s market share in desktop central processing units (CPUs) was 23.9% in the first quarter of 2024, an increase of 4.7 percentage points over the same period of the year. previous. Meanwhile, its share of notebook CPUs increased 3.1 percentage points to 19.3%. Information controls the rest of this market, but it’s worth noting that AMD has been rapidly chipping away at Intel’s market share.

The good part is that AMD is eyeing the AI PC market through its new generation of Ryzen processors equipped with dedicated hardware to enable AI applications. Its new Ryzen AI 300 processors offer 3x the performance of the previous generation in laptops. Most importantly, AMD estimates that its processors could power more than 150 AI software experiments by the end of 2024, and as a result its CPUs could continue to gain market share.

Therefore, there is a good chance that AMD will be able to sustain the impressive growth momentum it is witnessing in the client processor business right now. The company’s revenue from sales of CPUs deployed in laptops and desktops rose 85% year over year in the first quarter to $1.4 billion.

AMD is the smallest player in the client CPU market. So, if it continues to take market share away from Intel and make the most of the opportunity in AI PCs, whose sales are expected to increase at an annual rate of 44% over the next four years, its customers’ revenue could continue. improving at a healthy rate.

2. The data center business has some solid catalysts

AMD’s data center business is benefiting from the proliferation of AI in two ways.

First, the company’s data center graphics processing units (GPU) business is now gaining traction thanks to huge demand for AI accelerators. This year, AMD forecasts revenue of US$4 billion from sales of GPUs for data centers. The company has been raising its revenue expectations from data center GPU sales in recent quarters as more customers line up to buy its chips.

Given that AMD generated a total of $6.5 billion in revenue from its data center segment last year, it’s easy to see that this segment is on track to deliver robust growth in 2024. It’s also worth noting that AMD sold $400 million worth of data center GPUs in the fourth quarter of 2023, meaning it’s on track to achieve a much faster quarterly revenue rate in this business this year.

AMD’s data center GPU revenue could continue to grow at a good pace over the long term due to the huge revenue opportunity available in the AI chip market, as well as the company’s moves to make a bigger dent in this space by accelerating development. of your products.

However, there is another AI-related opportunity for AMD in the data center market, thanks to AI in the form of server processors. The company’s Epyc server CPUs are being deployed for AI inference applications and are driving solid growth in data center revenue alongside GPUs. More specifically, AMD’s overall data center revenue increased 80% year over year in the first quarter to $2.3 billion.

Considering that AMD has been gaining market share in server processors, investors can expect this fantastic growth to continue in the future. AMD’s server CPU unit market share increased 5.6 percentage points year over year to 23.6%, while its revenue share increased to 33%. This, once again, is happening at Intel’s expense and bodes well for AMD, as the global server market is expected to grow at more than 12% per year over the next five years.

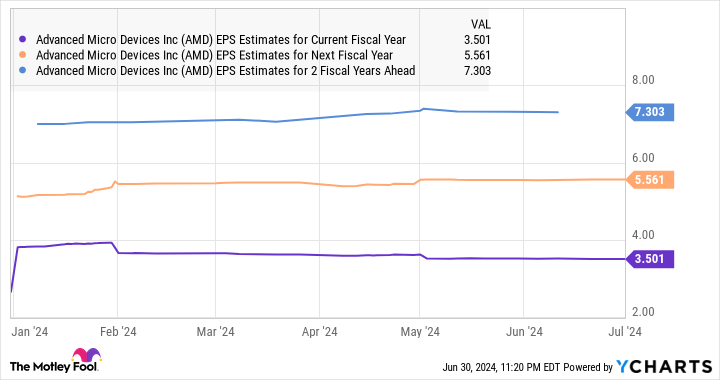

These catalysts explain why AMD’s growth is forecast to improve.

So, investors would do well to take advantage of AMD’s pullback, as the stock market could reward its stronger growth with more upside in the future.

Should you invest $1,000 in Advanced Micro Devices right now?

Before buying Advanced Micro Devices stock, consider the following:

O Motley Fool Stock Advisor the team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $751,670!*

Stock advisor provides investors with an easy-to-follow plan for success, including guidance on building a portfolio, regular analyst updates, and two new stock picks each month. O Stock advisor service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns July 2, 2024

Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions and recommends Advanced Micro Devices. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The motley fool has a disclosure policy.

Wall Street May Be Underestimating This Artificial Intelligence (AI) Stock: 2 Reasons You Should Consider Buying While It Remains Beaten was originally published by The Motley Fool