With Keir Starmer in power, savers must act now to protect their wealth from the new Labor government.

Protecting your money had already become more difficult after the Tories reduced tax allowances in April, but further changes could be coming soon.

The highest rate taxpayers, 40%, are already £335 worse off as a result of tax compression on savings and investments, according to estimates from wealth manager Quilter.

Investors could face an even bigger hit if Labor later raises taxes.

The capital gains tax allowance was brutally halved from £6,000 to £3,000 this tax year, while the dividend tax allowance fell from £1,000 to just £500. As a result of the cut, an additional 1.1 million people will have to pay tax on dividends from April 2024, according to HMRC figures obtained in a freedom of information request from stockbroker AJ Bell.

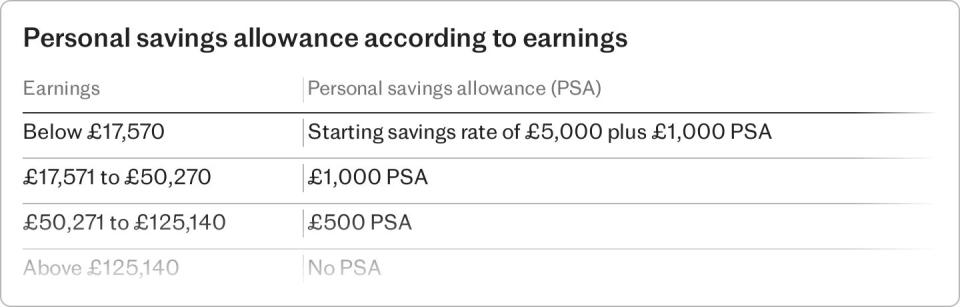

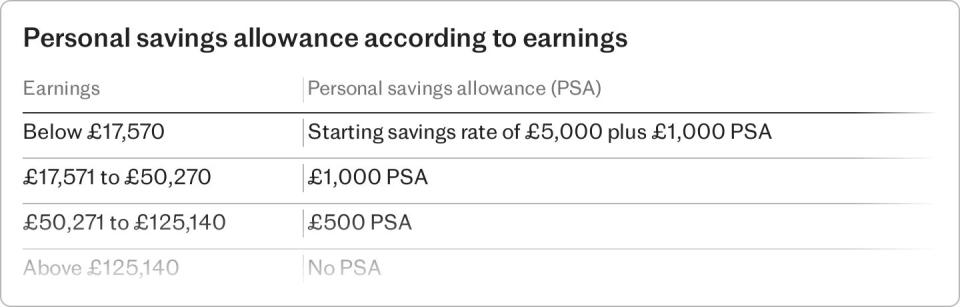

In addition to a tax crackdown on investment returns, the freeze on the personal savings allowance – the limit on how much savers can earn in interest before having to pay tax – means that savers are retaining less of the income they generate from of the money.

The personal savings allowance has been frozen at £1,000 for basic rate taxpayers and £500 for higher rate taxpayers since 2015. The hundreds of thousands of additional rate taxpayers which entered the 45pc range in 2023-24 they will not receive savings allowance.

As savings rates have risen to 5%, a higher rate taxpayer now needs just £10,000 in savings to exceed their personal savings allowance.

As a result, around 2.75 million people paid tax on the interest on their cash savings in the 2023-24 tax year, according to AJ Bell. This includes around one in 20 basic rate taxpayers, rising to one in six higher rate taxpayers and around half of higher rate payers.

The fiscal operation could be about to get even worse now that the Labor Party is in power. The party is determined to present itself as a party of tax cuts and has repeatedly highlighted former chancellor Jeremy Hunt’s use of “fiscal drag” to increase the tax burden.

The party ruled out increasing income tax or National Insurance if he wins the next election.

But some believe that Chancellor Rachel Reeves will have to raise taxes if the party is to fund its spending promises – and if that is the case, then taxes on “unearned income” from property or share portfolios are a target. obvious.

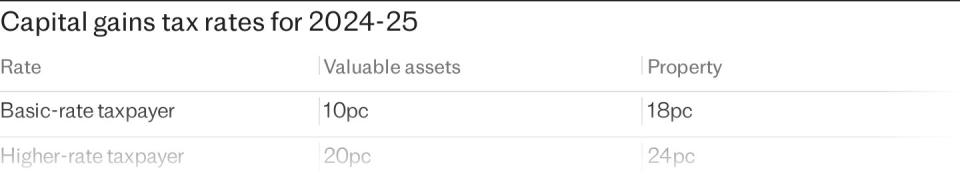

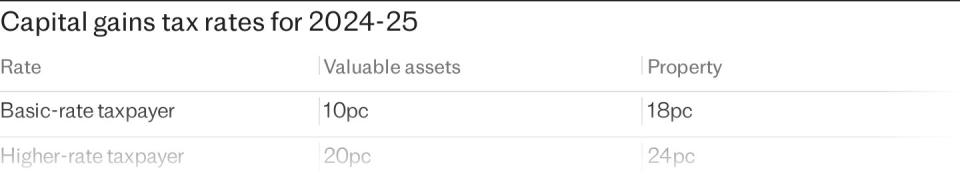

The party appears divided tax capital gains – with Angela Rayner, now Deputy Prime Minister and Secretary of State for Leveling Up, Housing and Communities, last year refusing to rule out a rate rise during an interview with BBC Radio 4, despite Reeves saying that “ I had no plans” to do that.

According to Quilter’s analysis, a rise in Labor capital gains tax rates could cost higher taxpayers an extra £900 in tax. This assumes a capital gain of £250,000 from the sale of a property and that capital gains tax rates are in line with income tax rates, as some have called for.

Selling a second home incurs capital gains tax of 24% (down slightly from 28% in 2023-24) if you are a higher rate taxpayer and 18% if you pay the basic rate of income tax. The fee is 20% and 10% for other assets such as shares.

The suggestion to align income and capital gains rates was first made by the Office of Tax Simplification, a now-defunct government agency. If that were to happen, the capital gains tax rates would be 20%, 40%, and 45%, depending on the seller’s income tax bracket.

Isas continue to be the most effective way of protecting your savings and investments from any tax changes.

A family of four could accumulate up to £116,000 in Isas between now and April 7, 2025, using all available allowances for tax years 2024-25 and 2025-26.

Pensions also allow earnings to be accumulated tax-free. A family of four, where both parents earn £60,000 each, could add £255,000 in both tax years. Although, of course, pensions are not accessible until at least age 55 and withdrawals are subject to income tax (in addition to the 25% tax-free allowance).

It takes a few minutes to set up an Isa or self-invested personal pension (Sipp) as long as you have personal and bank account details and National Insurance numbers.

Quilter estimated that individuals with £20,000 outside an Isa will lose £135 or £335 this year, depending on their income tax bracket, due to lost capital growth due to capital gains tax and dividend tax.

Shaun Moore, from Quilter, said: “Lower allowances and higher interest rates mean you are likely to find that your personal savings allowance, CGT exempt annual amount and dividend allowance will be decimated very quickly. Even just relatively small gains can waste huge amounts of your allowances in the next tax year and so the sooner assets can be in a tax-sheltered environment like an Isa, the better.”

If you currently have investments outside of a tax-free wrapper, you can sell them and transfer the proceeds to an Isa in a process called “Bed and Isa”.

Over time, the tax savings on capital gains can be huge. Assuming a £20,000 investment grows at 7% per year – with the income reinvested – then within ten years you would make a gain worth £19,343, according to Bestinvest. If it were held in an Isa, then this would all be tax-free – if it were held outside, then a higher rate taxpayer would pay £3,269 in tax, assuming the allowance remained at £3,000.

Inheritance tax can be another issue. A leaked recording of a shadow frontbencher raised fears that the party could be planning an attack on the family’s wealth after the death. Darren Jones told a public meeting in March that inheritance tax could be used to “redistribute wealth” and address “intergenerational inequality”. IHT revenues have already reached a record level thanks to frozen tax-free limits.

Labor could choose to cut or reduce the £325,000 tax exemption, widening the scope of inheritance tax, or attack various benefits that allow people to give away their wealth sooner, without paying inheritance tax. Any change could put your savings at risk as they will form part of your estate when you die.

Therefore, it may make sense to withdraw money from your property. You could do this by making giftsand using family benefits – this may be useful for IHT and other taxes too.

Laura Suter, of AJ Bell, said: “If half of the couple earns less or does not earn at all, there are tax advantages to transferring certain investments or savings into your name to make use of your lower tax rate. At the same time, if half of the couple has not exhausted their tax-free allowances in a year and the other half has, it may be worth transferring assets to benefit from their personal savings allowance, capital gains tax allowance or dividend tax. -free sum.

“Equally, if you have maxed out your Isa or pension allowance and your spouse has not, you should consider whether you want to transfer money into their name to use these allowances.”

Additionally, you can take advantage of the family allowance. You can invest up to £9,000 in Isa Junior for your child every year until they turn 18.

From April 2024, savers will be able to open as many Isas as they want, where previously they could only open one of each type. This will allow savers to more easily take advantage of the best savings rates on the cash Isa market.