Chrissy and her husband, Ryan, don’t grow up rich. To get ahead financially, they’ve long known that a combination of “hard work and frugality” would be necessary, Chrissy told Business Insider in an email.

So, when the couple found out about the FIRE Movement in his 20s, it was music to his ears.

FIRE is an acronym for “financial independence, retire early.” Generally, people who have embraced the FIRE movement want to increase their savings so they can achieve financial freedom It is retire before turning 65 – although some people I prefer to continue working. To achieve their goals, some FIRE advocates save most of your incometo assume lateral movementsor delaying costly life milestones, such as have children. Many FIRE advocates trace the movement’s philosophy back to 1992. best selling book “Your money or your life.”

To learn more about the FIRE movement, in particular strategies for maximizing savings and achieving financial independence, the couple searched FIRE-related YouTube videos, Facebook groups, newsletters and podcasts. They then tried to apply some of this information to their financial strategies.

Your efforts paid off.

In recent years, the couple has increased their combined net worth to more than $800,000, according to documents seen by BI. Chrissy said her goal is to grow her investments to about $2.5 million over the next 10 to 15 years — which she hopes will allow them to retire before she turns 50. She and Ryan are in their 30s.

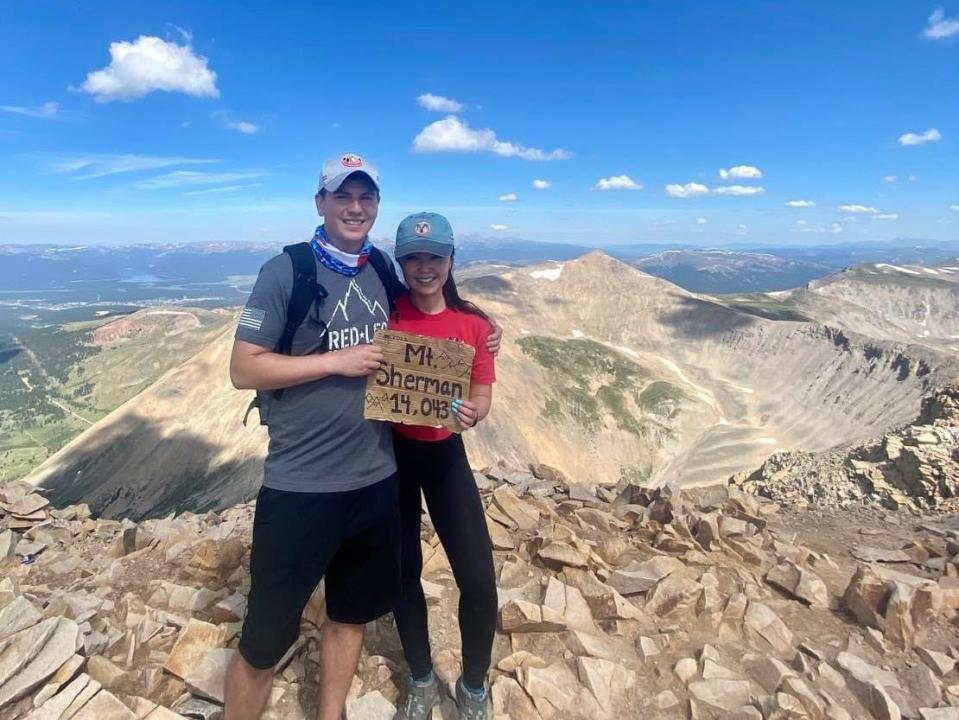

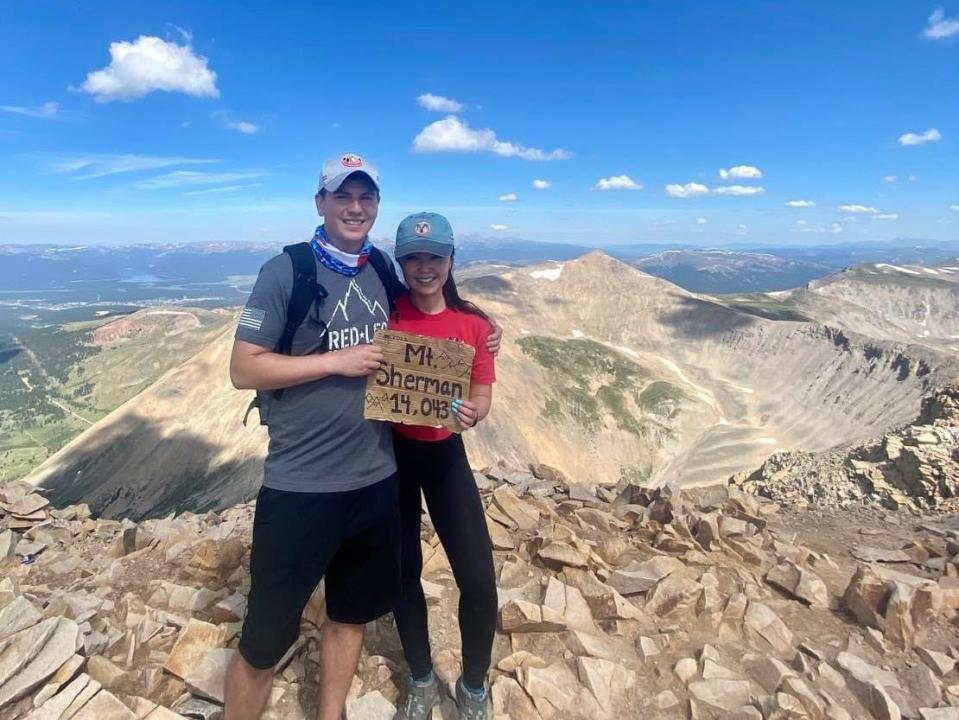

“Retiring at age 65 or older just doesn’t sound appealing,” said Chrissy, who works as a marketing director and lives in Colorado. “I’m sure we’ll still be active and healthy at this age, but there’s so much more we can enjoy in our 40s and 50s.” The couple’s last names have been omitted for privacy reasons.

Like many Americans struggle to save for retirement – and many retirees feel they don’t have enough to stop working — the FIRE movement offered a potential project for people who want financial security. Although some people have had success with FIRE, it has not been a good fit for everyone, in part because it can require significant savings goals that aren’t always realistic. However, FIRE proponents experience a wide variety of lifestyles. And experts say some FIRE principles — like the benefits of save and invest at a young age to enjoy compound investment returns – are applicable to a wide audience.

Chrissy shared her and Ryan’s top strategies for growing their savings — and the one lifestyle change that could make early retirement a little more difficult.

How to live a FIRE lifestyle

Chrissy summarized the couple’s financial strategy as “spend less, earn more and invest more.”

To spend less, she said they reduced how much they spend dining out in restaurants, purchased in bulk in CostcoThey planned their own vacations instead of using travel agents, avoided going to gyms by exercising at home, and limited their alcohol consumption.

They also postponed certain expenses to save some extra money.

“I spent many years with a broken phone screen and I didn’t really care,” she said.

To make more money, Chrissy said they “aggressively pushed for additional income.” For her, this took the form of “climbing the corporate ladder” – she said she earned a six-figure salary at age 26. registered nutritionistsomething she focuses on during evenings and weekends.

Ryan works full-time as a human resources professional. In her spare time, Chrissy said she focuses on managing the couple’s three investment properties, which provide them with passive income. The couple’s combined taxable income was about $250,000 in 2023, according to a document seen by BI.

When their strategies generate extra money, the couple invests as much as possible into their 401(k) and low cost index funds.

In case of emergency, the couple keeps around six months of resources in savings.

Chrissy said saving money was easier when she and Ryan lived in Indiana. The couple moved to Colorado during the pandemic, a few years into your FIRE savings journey.

One of the biggest differences between the two states is housing costs, Chrissy said. The couple lives in Monument, Colorado, where the average home value is about $743,000, by Zillow. In Fishers, Indiana, where they lived, the median home value is $426,000.

In the coming years, a change in lifestyle could put some additional pressure on the couple’s finances: they are expecting their first child, which they know will come many years later. new monthly expenses.

However, Chrissy said she thinks her financial goals are still achievable, in part because she and Ryan are planning for life with a newborn. They even planned how to finance their children’s potential college education.

“We started saving for your 529 plan so they can attend college,” she said, referring to the investment account that offers tax-free withdrawals when the money is used for certain educational expenses.

Are you part of the FIRE movement or do you follow some of its principles? Contact this reporter at jzinkula@businessinsider.com.

Read the original article at Business Insider