Share prices of CrowdStrike (NASDAQ:CRWD) have taken off since the beginning of June, with impressive gains of 22% as of this writing. There are a few reasons behind the cybersecurity specialist’s robust rally that helped it outperform one of the market’s hottest stocks during this period: Nvidia (NASDAQ: NVDA).

It’s worth noting that CrowdStrike’s gains last month are nearly double the 11% jump recorded by Nvidia stock. Much of the jump can be attributed to the fact that the cybersecurity company reported impressive fiscal 2025 first-quarter results (for the three months ending April 30) in early June. CrowdStrike exceeded Wall Street expectations and raised its fiscal guidance for 2025.

The company’s impressive results were followed by news that it would join the S&P 500 index, and that gave the stock another shot in the arm. These positive developments go a long way toward explaining why CrowdStrike shares are up nearly 50% in 2024.

Investors should consider buying this cybersecurity stock in anticipation of more perks? Let’s find out.

CrowdStrike’s AI-Powered Growth Is Here to Stay

CrowdStrike’s fiscal first-quarter revenue increased 33% year over year to $921 million. The jump in revenue was driven by increased customer spending on cybersecurity offerings. CrowdStrike reported that more than 65% of its subscription customers now use five or more of its cybersecurity modules. This represents an increase from 62% a year ago.

Even better, CrowdStrike reported a 95% year-over-year increase in the number of customers using eight or more cybersecurity modules (thanks to growing demand for its Falcon cybersecurity platform). CrowdStrike has integrated AI tools and capabilities into the Falcon platform, such as an AI-powered generative security assistant known as Charlotte AI, to help companies reduce response times to cyber threats.

In the future, CrowdStrike plans to innovate in the AI-enabled cybersecurity market by partnering with companies like Nvidia. The cybersecurity specialist will enable customers to use Nvidia hardware to train custom cybersecurity large language models so they can “improve threat hunting, detect supply chain attacks, identify anomalies in user behavior, and defend against proactively against emerging exploits and vulnerabilities.”

Such measures could help CrowdStrike capture a larger share of the AI-enabled cybersecurity market, which is expected to grow at a compound annual growth rate of 22% through 2031 and generate annual revenues of $114 billion by the end of the forecast period. . The growing adoption of the company’s AI-enabled cybersecurity platform will allow it to build a solid future revenue pipeline.

CrowdStrike’s remaining performance obligations (RPO) increased 42% year over year in the previous quarter to $4.7 billion. The growth of the metric outpaced the improvement in the company’s revenue, which bodes well for the future, as RPO refers to the total value of a company’s future contracts that have not yet been fulfilled.

The improved revenue pipeline also explains why CrowdStrike raised its 2025 tax revenue forecast to $3.99 billion, at the midpoint, from the previous estimate of $3.95 billion. The updated forecast points to a potential 31% jump in the company’s revenue compared to the previous year. But don’t be surprised to see CrowdStrike ending the year with stronger growth due to its solid RPO.

But is it worth buying shares now?

CrowdStrike’s better-than-expected results and improved full-year guidance undoubtedly fueled investor enthusiasm, but they also made the stock quite expensive. CrowdStrike currently trades at 28 times sales, which is significantly higher than the US technology sector average of 8.3.

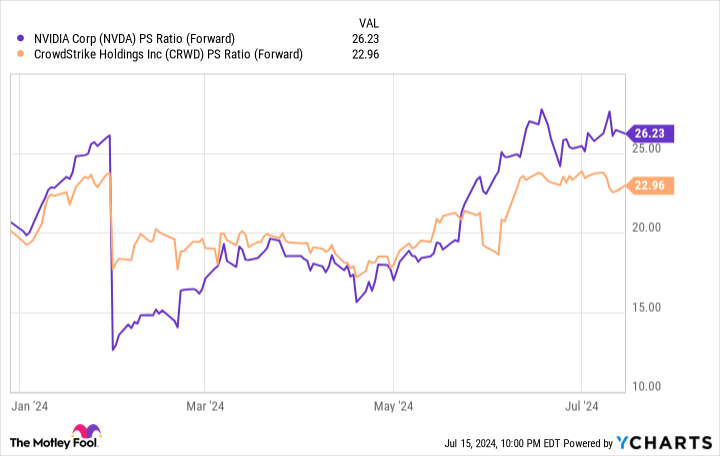

Piper Sandler analyst Rob Owens points out that CrowdStrike shares have the highest sales multiple of any public software company, with a market cap of more than $75 billion. Chip designer Nvidia, for comparison, has a price-to-sales ratio of 40, but is growing at a much faster rate than CrowdStrike. Additionally, a closer look at future sales multiples indicates that Nvidia is expected to continue growing at a faster pace, as its forward reading is much lower than its trailing sales multiple (its P/S is expected to fall from 40 to 26, while CrowdStrike is expected to go from 28 to 23).

Given that Nvidia is the dominant player in the AI chip market and has a brighter growth outlook, investors would be tempted to invest their money in the semiconductor giant instead of CrowdStrike. After all, CrowdStrike’s valuation is the reason Piper Sandler downgraded the stock from overweight to neutral.

Furthermore, CrowdStrike’s average 12-month price target of $400 (according to 48 analysts covering the stock) points to almost no upside from current levels. That’s why investors who missed this cybersecurity stock’s impressive rally in 2024 would do well to keep it on their watchlists and look for a better entry point before adding CrowdStrike to their portfolios.

Should you invest $1,000 in CrowdStrike now?

Before purchasing CrowdStrike shares, consider the following:

O Motley Fool Stock Advisor the team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $774,281!*

Stock advisor provides investors with an easy-to-follow plan for success, including guidance on building a portfolio, regular analyst updates, and two new stock picks each month. O Stock advisor service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns July 15, 2024

Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions and recommends CrowdStrike and Nvidia. The motley fool has a disclosure policy.

This artificial intelligence (AI) stock is outperforming Nvidia. Can this continue? was originally published by The Motley Fool

/cdn.vox-cdn.com/uploads/chorus_asset/file/24090214/STK171_VRG_Illo_4_Normand_ElonMusk_04.jpg?w=300&resize=300,300&ssl=1)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24020920/226270_IPHONE_14_REGULAR_PHO_akrales_0736.jpg?w=300&resize=300,300&ssl=1)