The last few weeks have been difficult for investors. Although stocks have risen since last week’s low, the S&P 500 it is still slightly below the July peak. It is also possible that the market will reach a lower low before all is said and done.

However, not every ticker is on the defensive. A handful of stocks are at or near record levels because investors understand that these few names offer something that most other stocks don’t right now – relative safety – and so people are getting into these companies just in case the recent market weakness be an omen.

Coca Cola (NYSE:KO) is one of those names. And I’m buying more, despite the recent increase. Here’s why you might want to do the same.

Coca-Cola is the epitome of resilience

Coca-Cola is the best-known brand in the world drink producer. In addition to the namesake soda, it has brands such as Minute Maid juice, Gold Peak tea, Dasani water and Powerade sports drink, to name a few.

But it’s not exactly the company you imagine. Although it did much of its own bottling, it has increasingly delegated this to third-party bottlers who buy flavored syrups from Coca-Cola itself. While this ultimately means less revenue, it also means higher margin revenue. Most importantly, this change freed the company to focus on doing what it does best. This is marketing.

But why are stocks rising to all-time highs when most others are on the defensive? And more than that, can this uptrend last?

The answer to the first question: we may be entering a period of economic lethargy that actually works in the company’s favor.

The country’s unemployment rate is starting to gradually rise and, on a global basis, the International Monetary Fund is lowering its expectations for near-term economic growth.

However, consumers are unlikely to give up their favorite drinks just because Money may be getting tighter. In fact, it’s debatable that people choose to enjoy these simpler, low-cost delights. more than they normally would if they didn’t spend more on more expensive purchases. (For perspective, despite the 2008 subprime mortgage meltdown and subsequent recession, Coca-Cola saw an 11% improvement in revenue on a 5% increase in volume.)

As for the second question, yes, there is room and reason to expect more progress from this stock, even if we see a small profit-taking from here. That’s still slightly below analysts’ average price target of $70.73. Most of these analysts still rate it as a Strong Buy.

That’s still not the main reason I’m betting on Coca-Cola right now.

A good time to worry about income

There’s never a bad time to own Coca-Cola. It’s a brand that consumers know and love, and management also clearly knows the beverage business. At the very least, it’s not likely to do any harm to your long-term portfolio.

My interest now is much more specific. Anticipating the aforementioned economic headwinds, I intend to increase my exposure to dividend-paying stocks. Perhaps there is nothing better than Coca-Cola stock.

The forward-looking dividend yield of 2.8% isn’t exactly a hindrance; you may find higher yields with other holdings. You won’t find a higher yield pick that is as reliable or with a comparable risk profile. The stock’s beta, which measures volatility, is about as low as 0.59 (the lower this number, the lower the volatility).

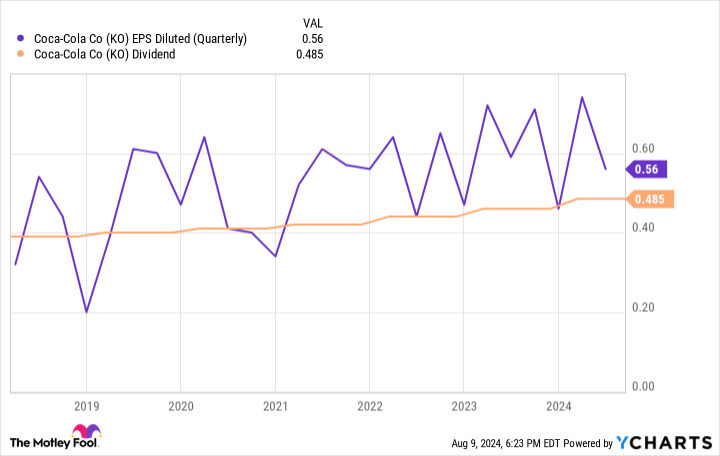

Consumers’ brand loyalty, even in difficult times, means they will continue to buy Coca-Cola, Minute Maid, Gold Peak, etc., and the company will continue to turn about a quarter of its revenue into net profit. In turn, you will continue to earn more than enough to fully fund your future dividends. Of the $2.79 per share Coca-Cola earned over the last four quarters, just $1.91 was consumed by dividend payments. That’s a comfortable margin.

The upside: Coca-Cola is not only a steady dividend producer, it has increased its annual dividend for 62 consecutive years. This streak is not likely to be broken now.

You should also know that I won’t necessarily reinvest these dividends into more Coca-Cola shares. Instead, I can build up a larger stockpile of cash so I can make purchases in the event of a more serious setback.

That seals the deal

Am I preparing too much for an economy that may never take shape? Possibly. But I’d rather play unnecessary defense with a quality company like Coca-Cola than get too aggressive and end up regretting it. After all, risk management is an important part of being a successful investor.

There is also the simpler optimistic argument that Coca-Cola is a quality holding regardless of the past or future scenario. It has a long-term track record of revenue and earnings growth that reflects its dividend history.

So I would say don’t overthink this and don’t worry about the recent extreme rally in stocks. Big stocks have a funny way of posting gains that don’t seem possible at the moment.

Should you invest $1,000 in Coca-Cola now?

Before buying Coca-Cola shares, consider the following:

THE Motley Fool Stock Advisor the team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $641,864!*

Stock advisor provides investors with an easy-to-follow plan for success, including guidance on building a portfolio, regular analyst updates, and two new stock picks each month. THE Stock advisor service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns on August 12, 2024

James Brumley has positions at Coca-Cola. The Motley Fool has no position in any of the stocks mentioned. The motley fool has a disclosure policy.

Coca-Cola shares reach new high. See why I’m doubling down. was originally published by The Motley Fool