Several technology companies have recently passed Stock splits. Some of the most notable tech stock splits in recent memory include members of the “Magnificent Seven” Tesla, Nvidia, Amazon, AlphabetIt is Litter.

While there are a number of upcoming stock splits you should know about, there’s one artificial intelligence (AI) company that I think could be next in line: Service now (NYSE: NOW).

Let’s find out why ServiceNow is an attractive stock split candidate and explore the investment merits of this software-as-a-service (SaaS) leader.

How do stock splits work?

Before diving into ServiceNow specifically, investors should understand the basics of stock splits.

Stock splits are essentially a form of financial engineering. The number of shares in circulation increases in proportion to the split. For example, in a 5-for-1 split, there will be five times as many shares after the split.

As a result, the price of the shares in question decreases by that same multiple. This dynamic means that the market value of the split shares does not inherently change.

Why would ServiceNow split its shares?

One of the most common reasons a company decides to split its shares is because the stock has soared significantly in a relatively short period of time. As a result, most retail investors consider stocks expensive and out of reach.

Again, although a stock split does not change the value of the company, investors tend to consider the shares cheaper because the share price is now lower. Subsequently, stock splits are typically followed by the entry of a new group of investors.

Since its initial public offering (IPO) in 2012, ServiceNow shares have risen 2,970%. Additionally, since AI became a focal point among technology stocks over the past 18 months, ServiceNow shares have risen 77%.

With a share price of $755, ServiceNow shares do not to look cheap. Considering that the company has never split its shares and that secular themes are fueling the AI landscape, now could be a unique opportunity for ServiceNow to follow in the footsteps of its larger technology peers as new gains appear to be in store.

Should you invest in ServiceNow stock?

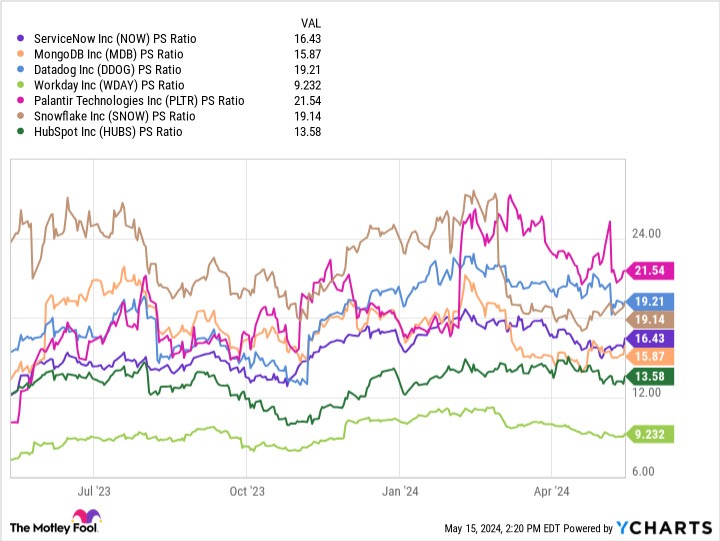

It is very important for investors to understand that stock price alone is not what determines a stock as overvalued or undervalued. In fact, the chart below illustrates that ServiceNow is largely trading at a discount based on price to sales (P/S) when compared to other SaaS growth stocks.

After analyzing the data above, there is a legitimate argument that ServiceNow is undervalued, despite its seemingly expensive share price.

Another way to look at this dichotomy is that it’s not the number of shares you own that matters; is the amount of money you are investing. It’s almost certainly a better idea to own one $1,000 stock than 1,000 $1 shares. Generally speaking, stock price reflects business sentiment.

When it comes to ServiceNow, there’s another reason I see the company as a potential stock split opportunity. As I expressed recently, ServiceNow is not as well-known in the areas of technology and AI as its competition. A stock split would be a good way for the company to grab headlines and potentially get on the radar of a broader group of investors.

That said, I’m not suggesting that ServiceNow should use a stock split as a PR stunt to boost its price. Investors should buy ServiceNow shares purely based on concrete business results.

Over the past few quarters, ServiceNow has made rapid strides in the world of AI, and it’s showing in the company’s results. Revenue growth is accelerating thanks to impressive customer retention metrics as well as ServiceNow’s ability to sell additional products and services.

Additionally, the company has established partnerships with MicrosoftNvidia and International Business Machines. I see these as important stepping stones to greater lead generation and new sales opportunities for long-term growth.

Ultimately, ServiceNow is a solid investment opportunity regardless of division. Now seems like a great time to pick up some stocks and prepare to hold out for the long term as the growth story continues to unfold.

Should you invest $1,000 in ServiceNow right now?

Before buying ServiceNow stock, consider the following:

O Motley Fool Stock Advisor the team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now… and ServiceNow wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia I made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $566,624!*

Stock advisor provides investors with an easy-to-follow plan for success, including guidance on building a portfolio, regular analyst updates, and two new stock picks each month. O Stock advisor service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Microsoft, Nvidia, Palantir Technologies and Tesla. The Motley Fool holds positions and recommends Alphabet, Amazon, Apple, Datadog, HubSpot, Microsoft, MongoDB, Nvidia, Palantir Technologies, ServiceNow, Snowflake, Tesla, and Workday. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The motley fool has a disclosure policy.

Prediction: This will be the next artificial intelligence (AI) company to split its shares was originally published by The Motley Fool

/cdn.vox-cdn.com/uploads/chorus_asset/file/25523084/VST_0709_Site.jpg?w=300&resize=300,300&ssl=1)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25520754/Screenshot_2024_07_07_at_12.01.27_PM.png?w=300&resize=300,300&ssl=1)